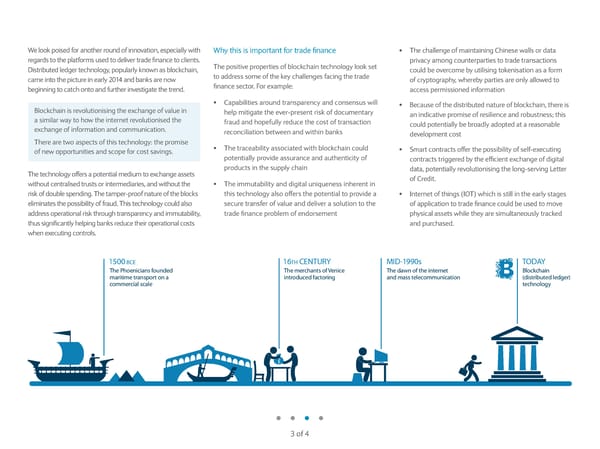

We look poised for another round of innovation, especially with Why this is important for trade finance The challenge of maintaining ƒhinese walls or data • regards to the platforms used to deliver trade finance to clients. privacy among counterparties to trade transactions istributed ledger technology, popularly known as blockchain, The positive properties of blockchain technology look set could be overcome by utilising tokenisation as a form came into the picture in early ‡ŒŠˆ and banks are now to address some of the key challenges facing the trade of cryptography, whereby parties are only allowed to beginning to catch onto and further investigate the trend. finance sector. For e„ample˜ access permissioned information ƒap abilities around transparency and consensus will • •ecause of the distributed nature of blockchain, there is •lockchain is revolutionising the e„change of value in • help mitigate the ever present risk of documentary an indicative promise of resilience and robustness† this a similar way to how the internet revolutionised the fraud and hopefully reduce the cost of transaction could potentially be broadly adopted at a reasonable e„change of information and communication. reconciliation between and within banks development cost There are two aspects of this technology˜ the promise The traceability associated with blockchain could • mart contracts offer the possibility of self e„ecuting of new opportunities and scope for cost savings. • potentially provide assurance and authenticity of contracts triggered by the efficient e„change of digital products in the supply chain data, potentially revolutionising the long serving –etter The technology offers a potential medium to e„change assets of ƒredit. without centralised trusts or intermediaries, and without the The immutability and digital uniueness inherent in • risk of double spending. The tamper proof nature of the blocks this technology also offers the potential to provide a Internet of things I›T which is still in the early stages • eliminates the possibility of fraud. This technology could also secure transfer of value and deliver a solution to the of application to trade finance could be used to move address operational risk through transparency and immutability, trade finance problem of endorsement physical assets while they are simultaneously tracked thus significantly helping banks reduce their operational costs and purchased. when e„ecuting controls. 1500 BCE 16TH CENTURY MID-1990s TODAY The Phoenicians founded The merchants of Venice The dawn of the internet Blockchain maritime transport on a introduced factoring and mass telecommunication (distributed ledger) commercial scale technology £ ™ of ˆ

Barclays | Trading Up Page 3 Page 5

Barclays | Trading Up Page 3 Page 5